Amex platinum – As the spotlight falls upon the American Express Platinum Card, we embark on a comprehensive exploration of its unparalleled benefits and rewards. This in-depth guide unveils the exclusive perks, travel privileges, and lifestyle enhancements that set the Platinum Card apart as the ultimate companion for discerning individuals.

Prepare to discover the secrets to maximizing your Platinum Card experience, from earning and redeeming points to accessing exclusive travel benefits and enjoying an elevated lifestyle. Join us as we delve into the world of Amex Platinum, where luxury meets convenience, and every journey becomes an extraordinary adventure.

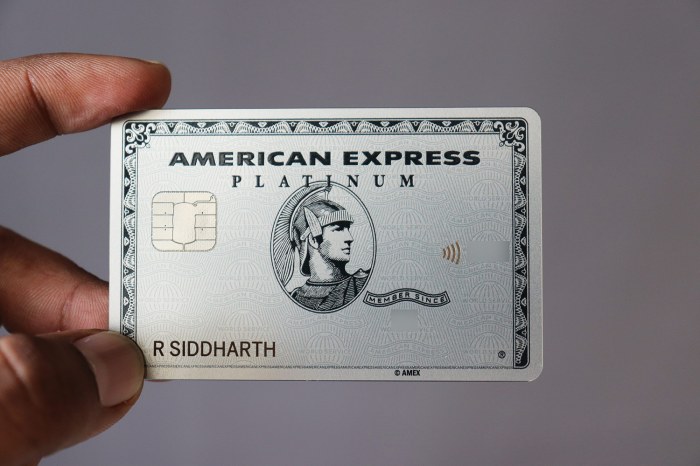

Overview of American Express Platinum Card

The American Express Platinum Card is a premium credit card designed for individuals with high spending power and a desire for exclusive benefits and experiences. It offers a wide range of perks, including airport lounge access, travel rewards, and concierge services.

American Express Platinum cardholders enjoy exclusive perks at luxury beach resorts , including complimentary upgrades, free breakfast, and access to private lounges. Whether you’re seeking a secluded retreat or a vibrant beachfront experience, your Amex Platinum card will enhance your stay at some of the world’s most desirable destinations.

The Platinum Card is particularly well-suited for frequent travelers and those who value luxury and convenience. It provides access to a global network of airport lounges, complimentary upgrades on flights and hotels, and exclusive experiences such as dining and entertainment events.

Target Audience

The American Express Platinum Card is primarily targeted towards individuals with high incomes and a sophisticated lifestyle. These individuals typically travel frequently, dine at fine-dining restaurants, and enjoy exclusive experiences. The card offers a suite of benefits that cater to their needs, providing convenience, luxury, and access to a world of exclusive opportunities.

Unique Value Proposition, Amex platinum

The American Express Platinum Card stands out from other premium credit cards with its unparalleled combination of travel benefits, exclusive experiences, and concierge services. It offers a comprehensive package that meets the needs of discerning travelers and those who seek the best in life. The card’s high annual fee is justified by the exceptional value it provides to its cardholders.

Comparison with Other Premium Credit Cards

The American Express Platinum Card competes with other premium credit cards in the market, such as the Chase Sapphire Reserve and the Citi Prestige. Here is a table comparing the key features of these cards:

| Feature | American Express Platinum Card | Chase Sapphire Reserve | Citi Prestige |

|---|---|---|---|

| Annual Fee | $695 | $550 | $495 |

| Lounge Access | Global Lounge Collection | Priority Pass Select | Citi Prestige Concierge |

| Travel Rewards | 5x on flights and hotels booked through Amex Travel, 1x on other purchases | 3x on dining and travel, 1x on other purchases | 3x on airfare and hotels, 2x on dining and entertainment, 1x on other purchases |

| Concierge Services | 24/7 Platinum Concierge | 24/7 Sapphire Concierge | 24/7 Prestige Concierge |

| Exclusive Experiences | Amex Experiences, access to fine-dining restaurants, entertainment events | Sapphire Moments, access to unique travel experiences | Citi Private Pass, access to exclusive events and experiences |

Earning and Redeeming Points

The American Express Platinum Card offers a generous rewards program that allows cardholders to earn and redeem Membership Rewards points. These points can be redeemed for a wide range of travel, dining, and other experiences.

There are several ways to earn points with the Platinum Card, including:

- Spending on eligible purchases: Cardholders earn 1 point per dollar spent on most purchases, and 5 points per dollar spent on flights booked directly with airlines or through American Express Travel.

- Enrolling in bonus categories: Cardholders can earn bonus points in certain spending categories, such as dining, travel, and entertainment.

- Referring friends: Cardholders can earn bonus points for referring friends who are approved for the Platinum Card.

Points can be redeemed for a variety of rewards, including:

- Travel: Points can be redeemed for flights, hotels, and rental cars.

- Dining: Points can be redeemed for meals at restaurants and takeout.

- Gift cards: Points can be redeemed for gift cards to a variety of retailers.

- Experiences: Points can be redeemed for experiences such as concerts, sporting events, and cooking classes.

To maximize point earning and redemption, cardholders should consider the following tips:

- Use the card for all eligible purchases to earn points on every dollar spent.

- Enroll in bonus categories to earn more points in categories that you spend the most in.

- Take advantage of special offers and promotions to earn bonus points.

- Redeem points for travel and other experiences that provide the most value.

Travel Benefits

The American Express Platinum Card offers a suite of exceptional travel benefits designed to elevate your travel experiences and make your journeys more comfortable and rewarding. These benefits include access to exclusive airport lounges, complimentary hotel status, and comprehensive travel insurance, ensuring a seamless and luxurious travel experience.

To access these benefits, simply present your Platinum Card at participating airport lounges, hotels, and travel providers. You can also manage your benefits and enroll in specific programs through the American Express mobile app or online account.

Airport Lounge Access

The Platinum Card grants you access to an extensive network of airport lounges worldwide, including American Express Centurion Lounges, Delta Sky Clubs, and Priority Pass lounges. These lounges offer a tranquil oasis amidst the hustle and bustle of airports, providing comfortable seating, complimentary snacks and beverages, Wi-Fi, and other amenities to help you relax and recharge before your flight.

Complimentary Hotel Status

As a Platinum Cardholder, you’ll enjoy complimentary Gold status with Hilton Honors and Marriott Bonvoy, unlocking exclusive perks and benefits at participating hotels. These benefits include room upgrades, late check-out, welcome amenities, and access to executive lounges, enhancing your hotel stays and making them more enjoyable.

Travel Insurance

The Platinum Card provides comprehensive travel insurance coverage, giving you peace of mind during your travels. This coverage includes trip cancellation and interruption insurance, baggage delay insurance, and emergency medical and dental insurance, ensuring that you’re protected against unforeseen events that may disrupt your trip.

Dining and Lifestyle Perks

American Express Platinum Card offers an array of exclusive dining and lifestyle perks designed to elevate your culinary and entertainment experiences.

Platinum Card members enjoy access to a curated network of fine dining restaurants, exclusive events, and premium lifestyle benefits. These perks are designed to enhance your dining experiences, provide access to exclusive events, and offer savings on premium products and services.

Restaurant Reservations

Platinum Card members can make reservations at some of the world’s most sought-after restaurants through the American Express concierge service. This service provides access to exclusive tables, priority seating, and special menus not available to the general public.

Special Events

Platinum Card members receive invitations to exclusive culinary events, such as wine tastings, chef demonstrations, and dining experiences hosted by renowned chefs. These events offer opportunities to meet industry professionals, sample exquisite cuisine, and enjoy unforgettable dining experiences.

Discounts and Savings

Platinum Card members enjoy discounts and savings at a wide range of restaurants, bars, and entertainment venues. These perks include complimentary dining experiences, exclusive discounts on meals, and access to premium seating at events.

Fees and Annual Benefits

The American Express Platinum Card comes with a hefty annual fee, but it also offers a range of valuable benefits that can offset the cost. Here’s a detailed breakdown of the fees and benefits to help you determine if the Platinum Card is right for you.

Annual Fee

The annual fee for the Platinum Card is $695. This is a significant expense, but it’s important to consider the value of the benefits you’ll receive in return.

Planning to attend the best cultural festivals worldwide ? With Amex Platinum, you can enjoy exclusive access to tickets, VIP experiences, and more. Whether you’re looking to immerse yourself in vibrant traditions or discover new cultures, Amex Platinum can elevate your festival experience.

Annual Benefits

The Platinum Card offers a wide range of annual benefits, including:

- Airport lounge access: Unlimited access to Centurion Lounges and Delta Sky Clubs, as well as access to over 1,200 other airport lounges worldwide.

- Travel credits: Up to $200 in annual statement credits for travel-related purchases.

- Global Entry/TSA PreCheck credit: Up to $100 every four years to cover the cost of Global Entry or TSA PreCheck.

- Fine Hotels & Resorts benefits: Access to exclusive perks at over 1,000 luxury hotels worldwide, including room upgrades, free breakfast, and late checkout.

- Dining credits: Up to $200 in annual statement credits for dining at select restaurants.

- Uber credits: Up to $200 in annual statement credits for Uber rides.

- Saks Fifth Avenue credits: Up to $100 in annual statement credits for purchases at Saks Fifth Avenue.

- Extended warranty: Extended warranty protection on eligible purchases.

- Purchase protection: Purchase protection against theft, damage, or loss for up to 120 days.

Cost-Effectiveness

Whether or not the Platinum Card is cost-effective for you depends on how much you value the benefits it offers. If you travel frequently, dine out often, and enjoy luxury experiences, the Platinum Card’s benefits can easily offset the annual fee. However, if you don’t travel much or don’t use the other benefits, the Platinum Card may not be worth the cost.

Compared to other premium credit cards, the Platinum Card’s annual fee is on the higher end. However, it also offers a more comprehensive range of benefits than most other cards. If you’re looking for a card that offers the best travel, dining, and lifestyle perks, the Platinum Card is a good option to consider.

Customer Service and Support

Platinum Card members have access to exceptional customer service and support, designed to enhance their cardholder experience. They can rely on dedicated phone lines, online chat, and in-person assistance, ensuring their needs are promptly addressed.

The personalized support available to Platinum Card members sets them apart. They are assigned dedicated account managers who are familiar with their individual preferences and can provide tailored assistance. This level of personalized service ensures that members receive the most relevant and efficient support for their account management, travel planning, and other inquiries.

Account Management

Platinum Card members can easily manage their accounts through dedicated phone lines or online chat. They can access real-time account information, make payments, and request changes to their accounts with the assistance of knowledgeable customer service representatives.

Travel Planning

Platinum Card members can benefit from personalized travel planning assistance. They can contact dedicated travel specialists who can help them book flights, hotels, and rental cars, as well as arrange for airport transfers and other travel arrangements.

Other Inquiries

Platinum Card members can also receive assistance with a wide range of other inquiries, including disputes, fraud protection, and general account-related questions. They can reach out to customer service representatives through dedicated phone lines or online chat, and their inquiries will be handled promptly and efficiently.

The American Express Platinum Card offers a range of travel benefits, including access to airport lounges and priority boarding. If you’re looking to make your travels more eco-friendly, there are plenty of eco-friendly travel tips available online. By following these tips, you can reduce your environmental impact while still enjoying all the benefits of travel.

The Amex Platinum Card can also help you offset your carbon footprint by allowing you to redeem points for carbon offsets.

Comparison to Other Premium Cards

The American Express Platinum Card is a premium credit card that offers a wide range of benefits and perks. However, it is not the only premium card on the market. Other popular options include the Chase Sapphire Reserve and the Citi Prestige. In this section, we will compare the American Express Platinum Card to these other cards to help you decide which one is right for you.

When comparing premium credit cards, it is important to consider the following factors:

- Annual fee

- Earning and redeeming points

- Travel benefits

- Dining and lifestyle perks

- Customer service and support

The following table summarizes the key features of the American Express Platinum Card, the Chase Sapphire Reserve, and the Citi Prestige:

| Feature | American Express Platinum Card | Chase Sapphire Reserve | Citi Prestige |

|---|---|---|---|

| Annual fee | $695 | $550 | $495 |

| Earning points | 1 point per dollar spent on all purchases, 5 points per dollar spent on airfare and prepaid hotels booked through American Express Travel | 1 point per dollar spent on all purchases, 2 points per dollar spent on dining and travel | 1 point per dollar spent on all purchases, 2 points per dollar spent on dining and entertainment, 3 points per dollar spent on airfare |

| Redeeming points | Points can be redeemed for travel, gift cards, merchandise, and more | Points can be redeemed for travel, gift cards, merchandise, and more | Points can be redeemed for travel, gift cards, merchandise, and more |

| Travel benefits | Includes a variety of travel benefits, such as airport lounge access, trip delay insurance, and baggage insurance | Includes a variety of travel benefits, such as airport lounge access, trip delay insurance, and baggage insurance | Includes a variety of travel benefits, such as airport lounge access, trip delay insurance, and baggage insurance |

| Dining and lifestyle perks | Includes a variety of dining and lifestyle perks, such as access to exclusive restaurants and events, and discounts on travel and entertainment | Includes a variety of dining and lifestyle perks, such as access to exclusive restaurants and events, and discounts on travel and entertainment | Includes a variety of dining and lifestyle perks, such as access to exclusive restaurants and events, and discounts on travel and entertainment |

| Customer service and support | Offers 24/7 customer service and support | Offers 24/7 customer service and support | Offers 24/7 customer service and support |

As you can see, the American Express Platinum Card, the Chase Sapphire Reserve, and the Citi Prestige are all premium credit cards that offer a wide range of benefits and perks. However, each card has its own strengths and weaknesses. The American Express Platinum Card is the most expensive of the three cards, but it also offers the most comprehensive set of benefits. The Chase Sapphire Reserve is a good option for those who want a card that offers a high earning rate on travel and dining. The Citi Prestige is a good option for those who want a card that offers a wide range of travel benefits.

Conclusion

The American Express Platinum Card stands out as an exceptional premium credit card, offering a suite of exclusive benefits and rewards tailored to discerning travelers, diners, and lifestyle enthusiasts. Its unique features, such as its generous welcome bonus, comprehensive travel protections, and access to exclusive experiences, make it a valuable choice for those who value luxury and convenience.

For individuals who frequently travel, the Platinum Card provides exceptional value. Its airport lounge access, priority boarding, and elite status with major airlines offer a seamless and comfortable travel experience. The card’s generous travel credits and points-earning potential allow cardholders to maximize their travel expenses and accumulate rewards for future trips.

Beyond travel, the Platinum Card caters to the discerning tastes of diners and lifestyle enthusiasts. Its partnerships with premium restaurants and its dining credits provide access to exclusive culinary experiences. The card also offers a range of lifestyle perks, including access to exclusive events, discounts on entertainment, and personal shopper services.

However, it is important to note that the Platinum Card comes with a significant annual fee. Potential cardholders should carefully consider their spending habits and lifestyle needs to determine if the card’s benefits outweigh its costs.

For those who prioritize luxury travel, fine dining, and exclusive lifestyle experiences, the American Express Platinum Card is an exceptional choice. Its comprehensive suite of benefits and rewards can enhance the cardholder’s lifestyle and provide exceptional value for those who fully utilize its offerings.

Final Summary

In the tapestry of premium credit cards, the American Express Platinum Card stands as a masterpiece, meticulously crafted to cater to the discerning traveler and lifestyle enthusiast. Its unparalleled benefits, exceptional travel privileges, and exclusive lifestyle perks elevate the cardholder experience to new heights. Whether you seek seamless travel, culinary adventures, or simply the finer things in life, the Amex Platinum Card empowers you to live life to the fullest, maximizing every moment with its unparalleled rewards and privileges.

FAQ Section: Amex Platinum

What sets the Amex Platinum Card apart from other premium credit cards?

The Amex Platinum Card offers a comprehensive suite of benefits tailored to discerning travelers and lifestyle enthusiasts. These include exclusive travel privileges, such as airport lounge access, complimentary hotel status, and travel insurance, as well as dining and lifestyle perks like restaurant reservations, special events, and discounts.

How can I maximize my point earning with the Amex Platinum Card?

The Amex Platinum Card offers multiple ways to earn Membership Rewards points. You can earn points on everyday purchases, travel expenses, and dining. Additionally, you can earn bonus points by taking advantage of targeted spending offers and using the card at select merchants.

What are the key travel benefits offered by the Amex Platinum Card?

The Amex Platinum Card provides an array of travel benefits, including complimentary airport lounge access to over 1,300 lounges worldwide, complimentary hotel status with select hotel chains, and comprehensive travel insurance. These benefits enhance your travel experience, ensuring seamless journeys and peace of mind.

How can I access the exclusive dining and lifestyle perks of the Amex Platinum Card?

To access the dining and lifestyle perks of the Amex Platinum Card, you can use the dedicated online portal or mobile app. These perks include priority reservations at popular restaurants, access to exclusive events, and discounts on dining, entertainment, and travel experiences.

Is the annual fee of the Amex Platinum Card worth it?

The value of the Amex Platinum Card’s annual fee depends on your individual spending habits and travel patterns. If you frequently travel, dine out, and enjoy exclusive lifestyle experiences, the card’s benefits can outweigh the annual fee. However, if you do not maximize the card’s benefits, it may not be the best choice for you.